Additional insurance premiums in the Azov and Black seas reach 5% of a vessel cost, Alexey Karchiomov, Head of International Trade and Customs, Maritime Shipping and Transport Law Practices at EPAM Law Offices, speaker from the Maritime Arbitration Commission at the Chamber of Commerce and Industry of Russia, said at the 3rd Annual Conference “Risks in Maritime Insurance: Best Practices, Russian and International Experiences”.

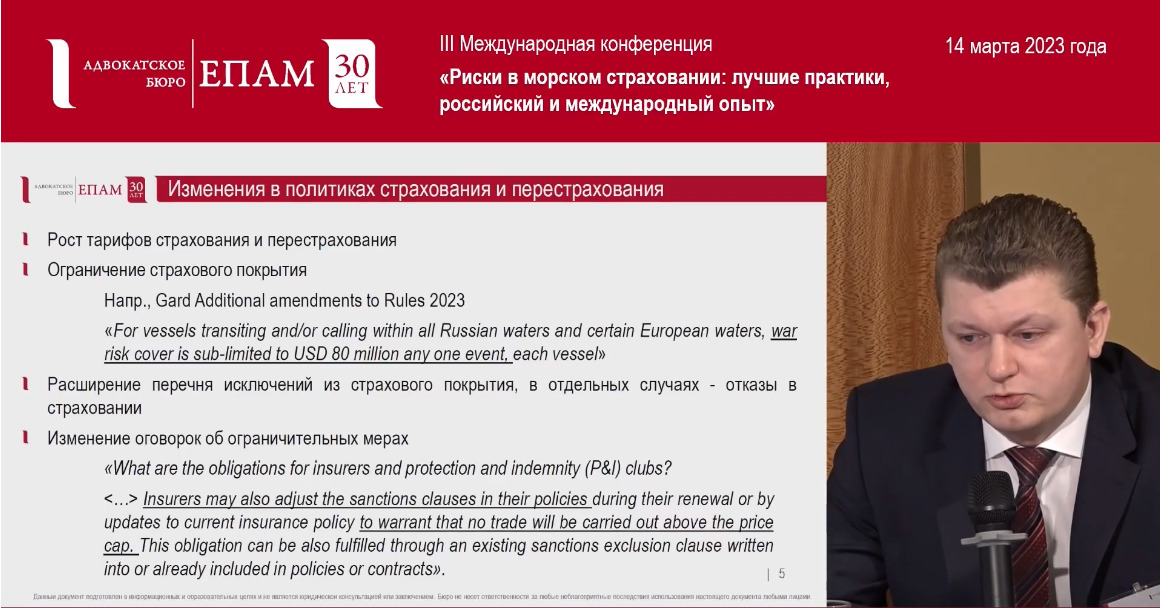

Besides, ships entering the territorial waters of Russia and certain zones of high military risks outside them are under limited insurance coverage with an expanded list of exclusions from insurance coverage, and denials of insurance in some cases.

Japanese insurance companies earlier stopped offering insurance coverage for ships entering Russian waters but that had a negative impact on supplies of liquefied natural gas (LNG) to Japan, so the insurance of such ship was resumed. Some grain deals were in the same situation.

Insurance companies were also able to impose restrictions on insurance in order to comply with the sanctions imposed on Russia. In particular, additional requirements could be impose, as was the case with Turkey, which demanded letters confirming P&I insurance for the passage of tankers with oil and petroleum products.

In 2022, the Black Sea and Sea of Azov were included into the list of high-risk areas by Joint War Committee (JWC), which includes Lloyd’s Market Association’s (LMA) syndicate members and representatives from London’s insurance company market. That decision was of recommendation character. The territorial sea of Russia was also included into the list of high-risk areas.