.jpg)

In the first half of 2023, the share of Russia’s foreign trade cargo handled in the ports of the neighboring Baltic states made 1.46% of Russian seaports’ total volume, down from 2.7% a year ago. However, handling of some Russian cargoes in the ports of unfriendly countries has increased.

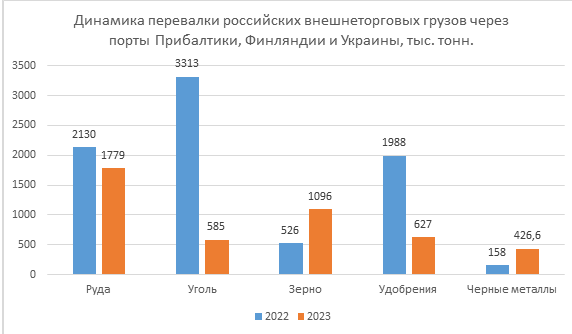

via the Baltics, Finland and Ukraine in thousand tonnes

The Federal Marine and River Transport Agency (Rosmorrechflot) says that transshipment of Russia’s foreign trade cargo via the ports of the neighboring countries – the Baltics, Finland and Ukraine (the latter having handled no Russian cargoes in HI’23 for obvious reasons) – decreased by about 43% to slightly over 6.6 million tonnes.

The cargo flow via the ports of the Baltic states decreased by 38% to about 6 million tonnes, via Finland – by 52% to about 635 thousand tonnes.

The steepest fall was registered in the segments of coal and fertilizers.

|

In brief In the first half of 2023, Russia decreased the share of its cargoes handled in the neighboring countries of the Baltic region to less than 1.5% of the total throughput of Russian seaports. Ultramar terminal in the port of Ust-Luga was a real ‘killer’ of the Baltic ports. However, Russian shippers increased handling of grain and metal in the Baltics’ ports and mineral fertilizers – in Kotka. |

Fertilizers cut to zero

Quite expectedly, the fall should be attributed primarily to mineral fertilizers. Russian shippers have virtually zeroed out the transshipment of fertilizers via the Baltics’ ports.

That is due to the operation of Ultramar, a new dedicated dry bulk terminal in Ust-Luga, as well as European Sulphur Terminal and some facilities in Great Port of Saint-Petersburg. Notably, the highest growth in handling of fertilizers was seen in the Azov-Black Sea Basin (by 170%), mostly in Novorossiysk and Tuapse.

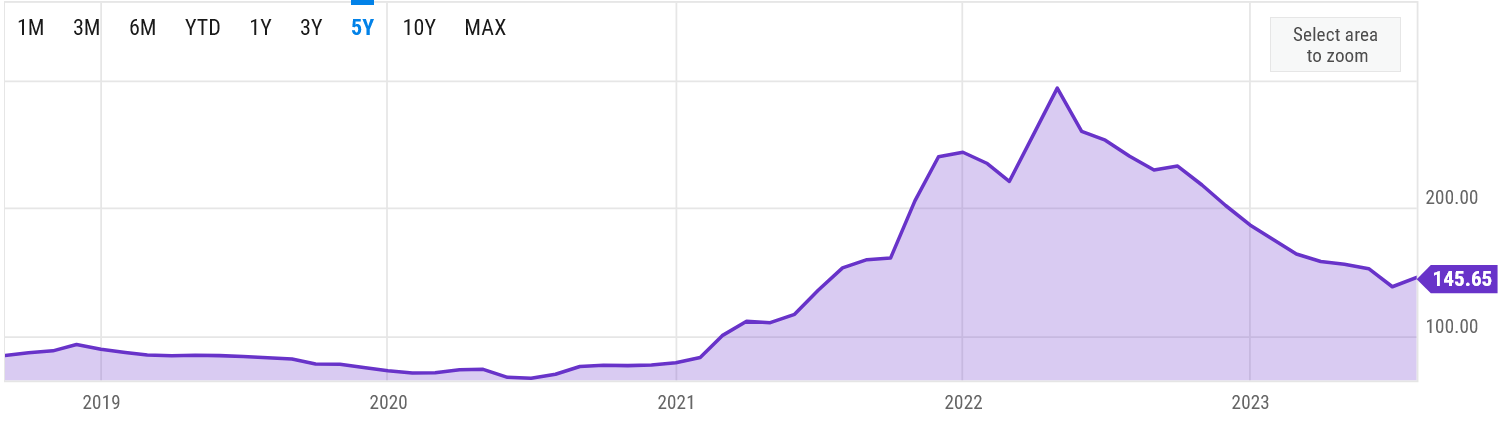

There is one nuance in the story of fertilizers – while the flow of Russian fertilizers via the Baltics is decreasing, the flow of this cargo via the Finnish port of Kotka has increased by almost one third, to over 600 thousand tonnes. In fact, the terminal operating in Kotka is connected with a Russian producer. Despite the decrease of global prices for fertilizers since spring 2022 they are still about twice as high as in pre-pandemic period while Russia is still the key supplier of fertilizers in the world. The global food crisis suggests that the demand for fertilizers will remain high in the foreseeable future. Therefore, exports of fertilizers from Russia can be expected to grow.

from https://ycharts.com based on Commodity Markets Review

The Baltics’ ports will hardly get anything from that but the development of new facilities in Russia should continue, especially in the Far East (which has no terminals specializing in handling fertilizers) and in the South. It is also crucial to increase the throughput capacity of railways in those directions. Moreover, it is necessary to build facilities for handling 11 million tonnes of Belorussian potash as we wrote earlier.

Outflow of coal

Handling of Russian coal is also decreasing in the Baltics’ ports. In the first half of the year, handling of Russian coal in the port of Ventspils fell six times (585 thousand tonnes), year-on-year. At the same time, handling of coal in the Baltic region of Russia increased 1.5 times, primarily due to the operation of Ultramar terminal which can be thus called ‘a killer of the Baltics’ ports’.

Indeed, there are no problems with coal handling in Russia today. As we see, there are sufficient facilities the Baltic region. In the North, Port Lavna is being actively built to handle 18 million tonnes of coal per year. In the South, there is OTEKO terminal able to handle bulkers of up to 220,000 dwt. —В—Л—Б. —В–Њ–љ–љ. As for the ports of the Far East region, the mostly consist of coal terminals.

Ore and metal

The situation in the segment of ore and metal is more complicated. The volumes of Russian ore handled via the ports of the Baltics increased by over a fourth, to 1.78 million tonnes, metal – 2.7 times to 427 thousand tonnes.

It should be noted that ore is likely to have been redirected from the ports of Ukraine which handled 371 thousand tonnes of ore in 2022. That is close to the increase in handling of Russian ore in the Baltics’ ports. Besides, Russian ore was transported via the ports of Finland. However, the volumes of ore in Russian ports did not decrease.

Daily bread

Foreign ports also saw an increase in handling of Russian grain, the volumes doubled to 1.1 million tonnes. That is because of the absence of grain terminals in the North-West Region of Russia (except for Kaliningrad). In this context, it should be noted that grain is now being handled in the port of Vysotsk after the diversification of its coal terminal. In the first half of the year, the terminal handled over 100 thousand tonnes of grain.

More industry-related content is available on our social media pages: YouTube, Telegram, Yandex Zen