After the cancellation of “zero tolerance" policy on COVID-19, the economy of China has been showing revitalization accompanied by a surge in coal consumption. Russia is the second country after Indonesia in coal imports of China. However, the capabilities of Russia are limited by the lack of transport infrastructure. The market players offer some measures to solve this problem.

|

In short To build up the supplies of Russian coal to China and other APR countries it is necessary to adopt indicative plans per industry for a synchronized shipment of various cargoes, to demonopolize seaports, to develop port railway stations and to apply the technology of transporting containers on gondola cars. |

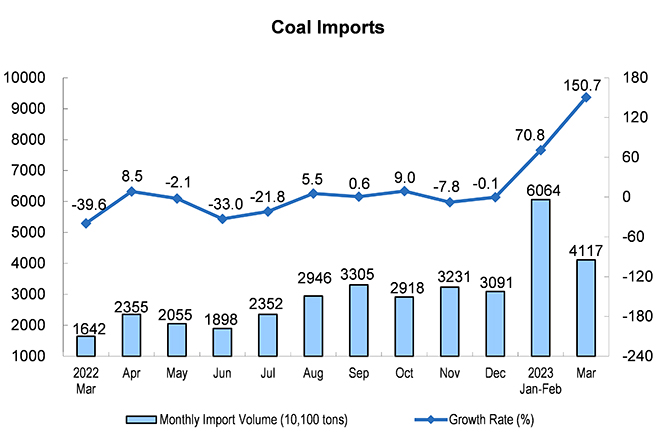

According to China’s National Bureau of Statistics, China’s coal imports in January-March doubled, year-on-year, to 100 million tonnes. Over the same period, coal production rose by 5.5% to 1.15 billion tonnes.

In March coal production totaled 420 million tonnes, up 4.3%, year-on-year. Coal imports in March totaled 41.17 million tonnes, up 2.5 times, year-on-year.

The diagram shows that the highest volumes of coal imports were registered in February. That is due to the replenishment of stock after the period of “zero tolerance" for COVID-19.

The share of coal in energy consumption of China is estimated at 56%.

According to China’s General Administration of Customs, supplies of Russian coal in January and February were up to 14.8 million tonnes, or 250,892 tonnes per day which makes Russia China’s second largest supplier of coal after Indonesia. One more significant supplier is Mongolia. Besides, Australia has returned to the market of China after a period of bad relations with China. Thus, the competition between the suppliers is increasing.

Coal trade between Russia and China is a win-win situation: the former gets a growing sales market amid the western embargo, the latter gets an attractively priced commodity.

As Irina Olkhovskaya, UMMC Director for Port and Rail Projects, said at the meeting of the working group “Cargo logistics: prospects of railway and port infrastructure development” held in the framework of the forum “Mining industry: investment projects and support measures”, coal is still among the most promising segments for cargo transportation.

“We were being told over the last year and in the beginning of this year that the coal market was declining, that its consumption was declining. However, the main driver of coal consumption, China, expanded the construction of coal power plants over the past year. Their commissioning exceeded the number of closed power plants around the world. Besides, they further strengthened the production. We also hear about the revival of coal production in Austria and in Germany amid the deficit of fuel resources,” the expert said.

The proposals of the business community

The growth of Russian coal transportation is hindered by the shortage of transport infrastructure on the Far East direction. The eastward pivot of logistics has led to the practice of using the Far East ports and the approaches to them not only for coal exports but also for large-scale transportation of containerized cargo. Both segments are crucial. Therefore, the working group participants have generated proposals which can help in transportation of all types of cargo.

According to the key market players, it is necessary to develop and adopt indicative plans per industry for a synchronized shipment of both mining products and containers.

The capacity of seaports should be built up as well and attractive conditions should be created for investors in this respect. Port should be excluded from the list of natural monopolies. That is essential for both the Far East basin and for the Arctic basin, the ports of which are getting increasingly important in the current situation.

When speaking about the Arctic it is reasonable to mention a new logistics scheme.

According to Leonid Feodorov, Deputy Head of the Yenisey Basin Administration, an experimental voyage will be held in the navigation season of 2023 to deliver a batch of Kuzbass coal by the Yenisey river and the Northern Sea Route to China. The first batch of 30 thousand tonnes will be partially transshipped in Krasnoyarsk and Lesosibirsk. “The cargo is to be delivered to the Yenisey Bay, the district of Ust-port, and reloaded onto a sea-going vessel, or even two vessels, and then shipped to the eastern region, most probably to China,” he said.

Nevertheless, such routes cannot serve as a full-fledged alternative to a traditional Far East route. When it comes to its railway part, facilitated implementation of projects on development of port stations is of the utmost importance. In the Far East, the main station is Nakhodka-Vostochnaya. According to Irina Olkhovskaya, the station handled 42.5 million tonnes in 2022 and is expected to handle 150 million tonnes per year by 2030.

“This is an objective reality already, the terminals are ready for this and it is necessary to promptly develop the station itself with turnout tracks at least, so that we increase the speed of the rolling stock exchange. There are various fleets: tank cars, platforms, gondola cars and the station services a coal terminal, the largest container terminal as well as a dry-cargo and petrochemical terminals. There is a plan to build new ones. It is necessary to be in the focus. It does not require billions of expenses. That is something that Russian Railways can do quite quickly and that will have an effect,” said the representative of UMMC.

The throughput growth can be also driven by new technologies for loading of containers onto gondola cars. Vostochny Port JSC organized its first shipment of containers in gondola cars using air bags in November 2021. The first train with a new type of fixing containers involving wooden braces was sent in December 2022. As of today, the loading of containers into gondola cars is as fast as the loading on platforms.

Optimized technology of container transportation also ensures considerable savings due to the discount of 20.7% for internal transportation of loaded containers in gondola cars. In 2022, such savings totaled RUB 166 million and they are expected to reach RUB 1.5 billion in 2023.

“Since all the segments depend on each other it is necessary to find ways of using various trains and cargoes for a maximum efficiency. We need solutions for building up the capacity of cargo transportation rather than for redistribution of cargo flows,” said Irina Olkhovskaya.

More industry-related content is available on our social media pages: YouTube, Telegram, Yandex Zen