A new shipyard for construction of large vessels on Kotlin island (where the city of Kronstadt is located) planned by Rosatom according to its announcement in summer 2022 may get one of the first orders from PAO Far Eastern Shipping Company. The parties are discussing the possibility of building 16 universal dry cargo container ships and 8 tugs. As far as IAA PortNews knows, the facility will first work as a distributed shipyard of Baltiysky Zavod which can also be partially controlled by Rosatom.

FESCO Transportation Group (parent company - Far Eastern Shipping Company, the group controls Commercial Port of Vladivostok and operates the fleet numbering 22 vessels) looks into construction of ships for its fleet at new Russian shipyards. The company is in preliminary discussions with Rosatom on construction of 24 vessels at a new shipyard on Kotlin island, FESCO representatives said at the expanded meeting of the inter-factional working group "Legislative Support of Import Substitution and Creation of Markets for Domestic Business" in the framework of the 26th International Forum-Exhibition “Russian Industrialist”.

“There are practically no Russian ships in the fleet of the group. The business is ready to buy ships. Together with our partner Rosatom we have already declared that we would order ships to the new shipyard in Kotlin, which is being built by the state corporation. They have got a pre-order from us, but the shipyard will not be launched before 2025-2026,” said Andrey Severilov, Chairman of the Board of Directors.

“We have practically adopted a programme for modernization, on the basis of which we are going to build ships. The programme includes about 16 universal dry cargo container ships and 8 tugs. We are willing to have them built in the Russian Federation, if we have such an opportunity. We work closely with our strategic partner Rosatom. We are ready to have those ships built at the facilities of Atomenergomash,” added Sergey Sidorov, Vice-president, Communication with Regions, Land and Property Relations.

As IAA PortNews reported earlier, United Shipbuilding Corporation (USC) and Rosatom may establish a joint venture at Baltiysky Zavod shipyard with 51% and 49% shares in it. Baltiysky Zavod is Russia’s leader in construction of nuclear-powered icebreakers. It is currently building a series of five nuclear-powered icebreaker of Project 22220 for Rosatom with the latter intending to extend the series with two more units.

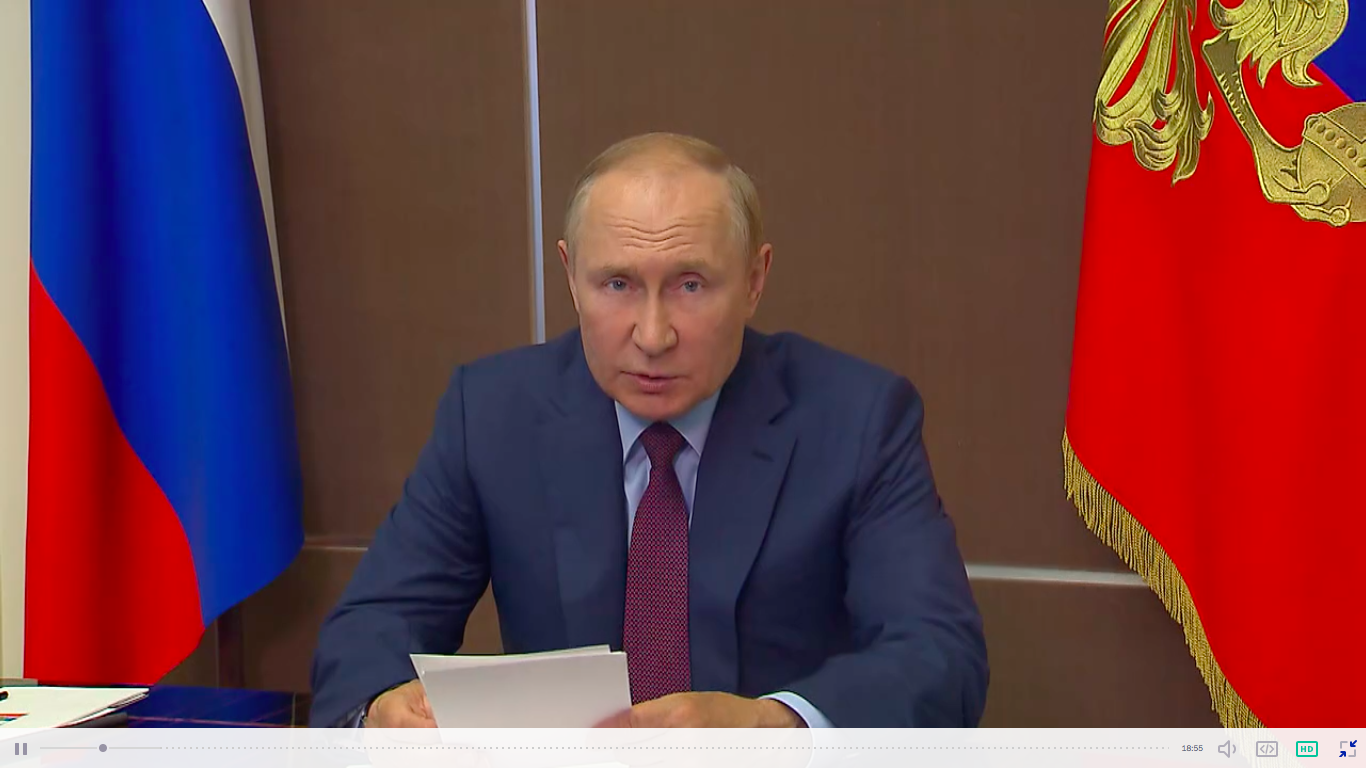

Alexey Likhachev, Director General of State Atomic Energy Corporation Rosatom, first spoke about the need to build a new shipyard for construction of large vessels at the meeting with Russian President Vladimir Putin in August 2022. One shipyard for high-tonnage ships is currently being built in the Far East by a consortium of Rosneftegaz, Rosneft and Gazprombank. The portfolio of the Far Eastern complex Zvezda is ensured by Rosneft, Gazprom and Rosmorport. Upon completion of modernization at Severnaya Verf in Saint-Petersburg (the deadline postponed several times is now set at 2024) the shipyard will be able to secure orders for larger ships. Alexey Likhachev earlier said the shipyard could build Russia’s first cruise liner.

“The experts we invited as well as our specialists and partners have come to the conclusion that a new shipbuilding facility needs to be built for large-capacity projects, given the historical limitations of the Baltiysky Zavod shipyard. We believe that a joint project between Rosatom and USC, primarily represented by the Baltiysky Zavod shipyard, is the most feasible option. It is a project proposed by the Shipbuilding and Shiprepair Technology Centre, a state research centre for shipbuilding,” Aleksey Likhachev said at the meeting.

“The plan is to build a large-capacity shipyard capable of processing up to 300,000 tonnes of metal at peak capacity; it includes several stages. The first stage of the project involves developing a model of a distributed shipyard for semi-knocked down assembly specialising in nuclear-powered ships, ice-class vessels and floating nuclear power units. The construction can comprise three phases. The ambitious goal is to complete the first phase of the semi-knocked down assembly facility in 38 months,” added Aleksey Likhachev.

According to the estimates of the Ministry of Industry and Trade (quoted by RBC), investments in construction of a shipyard for building high-tonnage vessels on Kotlin island may total about RUB 200 billion.

The Shipbuilding and Shiprepair Technology Centre assumes that, the new shipyard will first to cater for the needs of Rosatom, and only then for the needs for large-capacity projects.

“Consultations with Rosatom specialists on the creation of a new shipyard on Kotlin Island have been held for a long time. First of all, it will cater for the needs of Rosatom, then once the shipyard is built, it will cover the needs of the Russian Federation in high-tonnage ships,”said Yury Gabdrafikov, Deputy Director General for Research and Production Activities, Shipbuilding and Shiprepair Technology Center, told IAA PortNews.

According to the research of Infoline on Shipbuilding Industry of Russia, about 600 ships were under construction at Russian shipyards as of Q1’2022. The total value of ships, both under construction and contracted ones, exceeds RUB 3.2 trillion while the total tonnage exceeds 7.4 million.

Despite the policy aimed at import substitution and local production of ship components being implemented since 2015, Russia’s dependence on imports remains high in 2022: in certain categories, the share of imports varies from 40% to 90%. Segments most affected by sanction introduced after February 2022 include those of large-capacity tankers (76% of the total tonnage under construction), fishing and crab catching ships (5%), passenger and research vessels are at risk due to the high share of imported equipment and the need to redesign vessels for installation of domestically produced equipment. Mikhail Burmistrov, General Director of Infoline-Analytics believes that the negative impact sanctions will inevitably lead to postponement of deliveries up to 1 year on the average if one or two key components needs substitution or up to 2-3 years for larger ships with larger share of imported equipment.

The plans of Rosatom and USC to build a new shipyard for construction of high-tonnage ships on the basis of Baltiysky Zavod are generally logical, if viewed solely through the prism of the two corporations’ business plans. However, taking into account the current economic situation and availability of other production facilities that have already absorbed billions of dollars of investments, a new mega-shipyard project may fail to get the support of investors, believes Yury Fedyukin, Managing Partner at Enterprise Legal Solutions. “Given the long period of construction, there are risks that this project may face a number of challenges. I believe that both USC and Rosatom have enough unfinished orders in their portfolio, investments in which are more urgent as compared with using those resources for a new shipyard. I’d like to remind that this industry regularly requires additional financial investments in component R&D for and in the new reality they are required for subsidizing parallel imports on which the quality of current production depends directly. Therefore, the prospects of the project are doubtful at the present phase," the expert emphasized.

Mikhail Grigoryev, Head of consulting company Gecon, believes that Russia needs a new shipyard for construction of large ships.

“The task of building a new shipyard is determined by the need to create our own large-tonnage fleet, the construction of which at existing shipyards is very limited. Unfortunately, the tasks, transport projects and shipping lines or the number of ships needed have not been defined yet. The types, deadweight, ice classes, and so on have not been defined either. The total number of ships that has been announced does not make it clear. It is necessary to estimate the real need for high-tonnage vessels, first of all, container ships, bulk carriers and tankers,” he says.

Actually, only Zvezda, which is loaded for the coming years, can build large ships, other shipyards have no experience in building high-tonnage ships, and the don not basically have a technical capability, added the expert. The creation of a cluster for the construction of a large-tonnage ships in the Baltic region with a shipyard on Kotlin island is justified by a number of factors. A new shipyard focused on construction of high-tonnage ships would hardly be advisable for building smaller vessels - tugs, support vessels and others that existing shipyards can undertake.

However, a number of issues should be addressed when creating the shipyard: the issue of personnel recruitment (in case of Zvezda shipyard, it exceeded 7 thousand people), the supply of equipment for metalworking. Besides, Kotlin island is remote from St. Petersburg, hence the need for social infrastructure development - from construction of residential areas for workers to clinics and schools, summarized Mikhail Grigoriev.