With EU embargo on imports of Russian oil effective from December 5, the tanker fleet will be obviously redirected to cargo supplies to Asia. Shipbroker Braemar expects that to entail the need for more ships. According to Lloyd’s List referring to Braemar analysts, Russia will need a capacity equivalent to nearly 300 Aframaxes for its oil transportation to the APR region.

There’s been a sharp rise in the tanker trading since February 2022 and in the run-up to the EU ban on Russian crude oil (comes into effect on 5 December 2022) by entities based in countries such as Dubai, Hong Kong, Singapore and Cyprus, according to the report of Braemar.

Shipbroker Braemar estimates that to support four million barrels a day of Russian exports to the far east, many of the recently-transacted vessels will need to be added to the 240 ships -- 102 Aframaxes, 58 Suezmaxes and 80 very-large crude carriers. According to Anoop Singh, head of tanker research at ship broker Braemar, those can be vessels from the shadow fleet that have carried Iranian and Venezuelan crude. According to Lloyd’s List referring to Braemar analysts, Russia will need a capacity equivalent to nearly 300 Aframaxes for its oil transportation to the APR region.

EU embargo

The EU’s sixth sanction package states that seaborne crude oil imports must cease by 5th December with refined product imports being wound down 2 months later. Landlocked countries will be allowed to continue importing pipeline crude until a wholescale switch to non-Russian barrels is feasible.

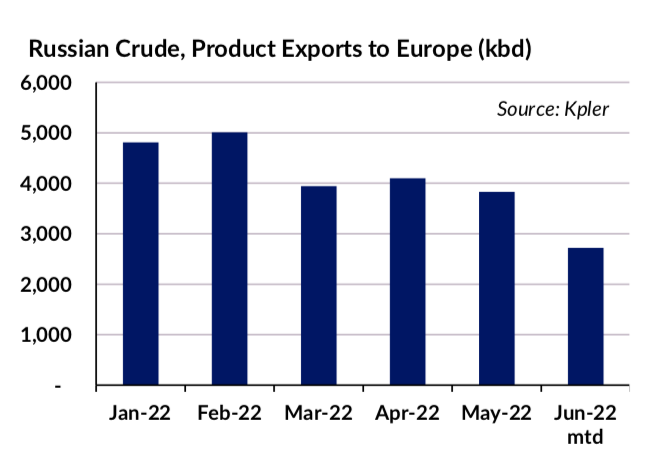

The result of these sanctions is that some 2.5 to 3mbd of crude oil and 1.5mbd of refined products will have to find a new home, or simply not be produced. “The reality will be a combination of both. Production and refinery run rates are likely to fall, the extent of which will depend on export demand for Russian barrels. Undoubtedly some barrels will be diverted from Europe to India and China, as has been observed already, although it is unclear to what extent these countries might be willing to raise imports,” reads the report.

ING forecasts the global demand for oil to grow by 2 million barrels per day in 2022 with the same growth expected in 2023. Thus, the year of 2023 is to see the global demand to exceed the pre-pandemic level. However the outlook depends on the recovery of Chinese economy and the level of recession in the USA and Europe.

International Energy Agency (IEA) says Russian oil exports fell to 7.5 mb/d in September, down 560 kb/d from the levels before February 2022. With less than two months to go before a ban on Russian crude oil imports comes into effect, EU countries have yet to diversify more than half of their import levels away from Russia.

Demand for tankers

TradeWinds says a hot sale-and-purchase market pushed tanker value indicators to new 13-year highs as the volume of deals has made 2022 the busiest year yet in the sector. According to VesselsValue, sale and purchase activity for tankers remains firm, 890 transactions were recorded in the first three quarters of 2022, up 17% year on year and tanker values have risen across the board since January.

In October there was a clear trend towards older tonnage. Sales include the Suezmax Nordic Cosmos (160,000 DWT, January 2003, Samsung) sold to undisclosed buyers for USD 21 million. Also, the LR2s Sea Legend and Alburaq (112,500 DWT, Dec 2008/Oct 2008, Hyundai HI) sold to undisclosed buyers for USD 35 mil each.

Anoop Singh also marks high prices for tankers: “When 17 year ICE class Aframaxes are going for USD33m a piece you know the market is working very hard to solve a very hard problem,” he posted on his social media page.

Dmitry Grushevenko, expert of the Energy Research Institute of the Russian Academy of Sciences (ERI RAS), believes there is a need to expand the fleet although it is hard to estimate the number of ships needed. “Much depends on how logistics and routes are organized. Perhaps, about 80 tankers of Suezmax class or larger are needed. However, the final number can be reduced taking into account the growth of ESPO volumes and supplies by BAM which is under expansion,” says the expert emphasizing that freight can be ensured by intermediaries while supplies to China can be organized according to a scheme with consignees being in charge of freight and insurance as it was in the case with Iranian oil.

“Information is not transparent, hence no accurate estimates on the fleet. With the time of round voyages increasing as compared with those linking Western Europe with Primorsk, the need for ships will grow at least six times,” says Mikhail Grigoryev, Head of consulting company Gecon.

According to Yury Shcherbanin, Head of Department for Oil & Gas Trading and Logistics at the National University of Oil and Gas named after I.M.Gubkin (Gubkin University), actual changes in shipment of Russian crude oil and oil products will become clear only after December 5. He also reminds that apart of EU restrictions, there are technical and technological parameters as well as types and sizes of tankers that can be serviced in Russian basins. “That is connected with the passage of the Danish straits, the Bosphorus strait, the depth of berths, the capacity of tank farms and the railway,” he explains.

More industry-related content is available on our social media pages: YouTube, Telegram, Yandex Zen