Despite the general fall of volumes exported via the neighboring non-CIS Baltic ports in the first half of 2021, exports of mineral fertilizers, grain and metal via the foreign terminal continue growing.

Total handling of Russia’s foreign trade cargo at the ports of the neighboring Baltic states decreased by almost 15% in H1’2021 to 9.3 million tonnes which accounts for about 2% of the Russia’s exports via the seaports. It seems like dependence on foreign ports has been eliminated but that is not entirely so.

Actually, the fall of shipments via the foreign Baltic ports should be attributed to ore exports which plunged by 17% to some 1.3 million tonnes while the scope of other dry bulk handling increased considerably: the flow of Russian mineral fertilizers via non-CIS Baltic ports rose by 8% to 4.4 million tonnes, grain – 3.5 times to almost 750,000 tonnes, ferrous metal – 1.5 times to 214,000 tonnes, non-ferrous metal – 1.4 times to nearly 500,000 tonnes (according to data of RF Transport Ministry’s bodies).

As for ore, the situation is not that trivial. In fact, ore shipments via the port of Ust-Luga also increased because one of its terminals handled essential volumes of ore while rejecting handling even more essential volumes of mineral fertilizers (compared to H1’2020). At the same time, Big Port St. Petersburg also demonstrated a decrease in this segment.

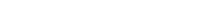

In general, ore flows were redirected to the Far East ports where they grew by 16% while the southern ports saw a considerable decrease amid the market situation. This year, freight rates in the segment of dry bulk carriers have reached their highest level over a decade having exceeded $30,000 per day for Panamax and Capesize ships with Asian countries accounting for the bulk of the demand (see a graph below).

Anyway, it is too early to attribute the changes in the segment of ore handling to the development of port infrastructure in Russia.

Notably, handling of Russian ore decreased even in the Finnish port of Kokkola which showed an impressive growth last year. This confirms a general trend towards the change of export flows. Read more about exports via Kokkola port >>>>

Meanwhile, exports of mineral fertilizers via the port of Ust-Luga plunged by almost a third with exports of ferrous metal also demonstrating a decrease. Thus, foreign ports are still popular among Russian shippers whereas new bulk terminals have not been put into operation and Belarus’ fertilizers have not come to Russia yet.

The same is true of grain: amid the growth of Russian grain exports via neighboring countries’ ports the volumes of grain handled at Big Port St. Petersburg were decreasing with Sodruzhestvo Soya in Kaliningrad being the only terminal showing an increase. Needless to say that apart from Kaliningrad Russia has no dedicated grain terminals in the Baltic Region while the construction project of Sodruzhestvo Soya in the Leningrad Region was killed due to the ecologists’ protests?

Will this picture be changed with introduction of new dry bulk handling facilities in the Baltic Basin of Russia, particularly in Ust-Luga and Primorsk? Potentially, it will since specialized facilities are to ensure shipment of large cargo batches and reduce the cost of their storage and transshipment but it will actually depend on the global market situation and specific agreements with shippers. As of today, it should be admitted that Russia is still dependent on its neighbors in some segments although this dependence is not critical in terms of general export volumes.

By Vitaly Chernov

By Vitaly Chernov

news@portnews.ru

More industry-related content is available on our social media pages: FaceBook, YouTube, Telegram, Twitter, Yandex Zen