Russia’s western gate is still being used for coal exports despite the EU embargo imposed in August. Over 30 days of October, loading of export coal bound for the North-Western ports grew by 8.6%, year-on-year, to 4.6 million tonnes, Russian Railways told IAA PortNews. According to Gibson Shipbrokers, that can be explained by the easing of sanctions pressure on EU-based shipping companies which are still allowed to export Russian coal to the third countries. According to analysts, high loading of the Eastern Polygon is the key factor.

Over 30 days of October, loading of export coal bound for the North-Western ports of Russia grew by 8.6%, year-on-year, to 4.6 million tonnes, Russian Railways told IAA PortNews. Review of coal exports per RF basins has not been published yet.

BIMCO analysts earlier said that Russia’s coal exports over 9 months have dropped by 7% versus January-September 2021. According to PortNews, exports of coal and coke from the ports of the Russian Federation in the 9-month period of 2022 totaled 150.3 million tonnes with a decrease of less than 3%.

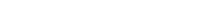

The Far East Basin traditionally accounting for the bulk of coal shipments reduced the result by 2.8% to 79.6 million tonnes (major terminals in the region are Vostochny Port JSC, Daltransugol JSC, VTU JSC< Nakhodka MTP JSC, Port Vera LLC, Trade Port Posiet JSC and Commercial Port of Vladivostok PJSC). Meanwhile, the Azov-Black Sea Basin increased coal shipments by 26.7% to 30.8 million tonnes (OTEKO-Portservis LLC, Tuapse MTP JSC). The Baltic Basin showed a 21-pct decrease to 28.8 million tonnes (Rosterminalugol JSC, Noviye Kommunalniye Tehnologii LLC, Port Vysotsky LLC).

Among the key factors promoting growth of shipments from the North-Western ports is the high loading of the Eastern Polygon making it unable to meet all the requests of coal companies, says Sergey Kondratyev, Deputy Head of the Economic Department at the Institute for Energy and Finance (IEF). Besides, discounts offered by Russian coal producers amid relatively high prices contribute to the recovery of the external demand for Russian coal. “Shipments to Turkey, North Africa and India have increased considerably and part of those flows run via the Baltic ports,” he says.

According to the expert, the Leningrad Region ports retain their attractiveness due to a balanced tariff policy, redirection of flows from the Baltic states and overloading of the Eastern Polygon which is currently the main direction for transportation of containers.

The USA stopped importing Russian coal in February 2022, Australia – in April, the EU countries – from August. The Great Britain is going to stop purchasing Russian coal by the end of 2022. Japan and South Korea have announced their plans on gradual reduction of coal consumption. Still, Russia is the second country in the world in terms of coal reserves and the sixth in terms of production. Along with Indonesia and Australia it is among the three leading suppliers of coal – together they account for over 80% of the global coal exports.

In September, The European Commission published clarifications on the embargo imposed in August. According to them, EU-based shipping companies can continue transporting Russian coal to third countries. Services such as financing and insurance of coal transport can be offered as well. Embargo on Russian crude oil and petroleum products comes into effect on December 5 (The U.S. is set to allow transactions up to 19 January 2023). However, if the price cap fails to materialize, EU shipping companies might be allowed to continue transporting Russian crude to third countries, as has been the case with Russian coal exports, according to Gibson Shipbrokers.

In 2022, China remains the largest buyer of Russian coal which accounts for 22.6% of the country’s total imports. Although China’s coal imports have reduced by 25.7% this year, imports from Russia have increased by 3.5%, mostly due to the price reduction. Over 8 month of 2022, India increased imports of Russian coal 2.2 times to 4.37 million tonnes, NCR earlier told IAA PortNews.

The Ministry of Industry and Trade expects the results of coal production in 2022 to decrease by 20 million tonnes versus 2021, mostly due to the reduction of exports. The Institute for Energy and Finance believes that the decrease of coal exports can be up to 22-25 million tonnes to 200 million tonnes in 2022. The International Energy Agency forecasts the global demand for coal to climb by 1% from 2021 to 8 billion tonnes in 2022 which is comparable to the record high demand of 2013.

According to the media reports, the government is considering introduction of discounts for railway transportation of coal to the North-Western ports which can help recover their loading. In the opinion of Sergey Kondratyev, even with the October dynamics of shipments, the issue of discounts is still relevant since the growth of flows to the North-West is driven by the absence of alternatives for coal producers amid the lack of the Eastern Polygon capacity rather than by the favorable market situation. “Meanwhile, coal prices are decreasing and he discounts for Russian coal reach 40-60%. Therefore, a discount of Russian Railways’ tariffs would be beneficial for coal companies,” he summarized.

More industry-related content is available on our social media pages: YouTube, Telegram, Yandex Zen