On the one hand, methanol is considered to be one of the most promising types of marine fuel, on the other hand, it is being criticized as a toxic fuel. Besides, wide application of it is hindered by a shortage of production facilities and the related infrastructure. The surge of natural gas prices boosts the interest to methanol. This review covers worldwide introduction of methanol as a marine fuel in 2022.

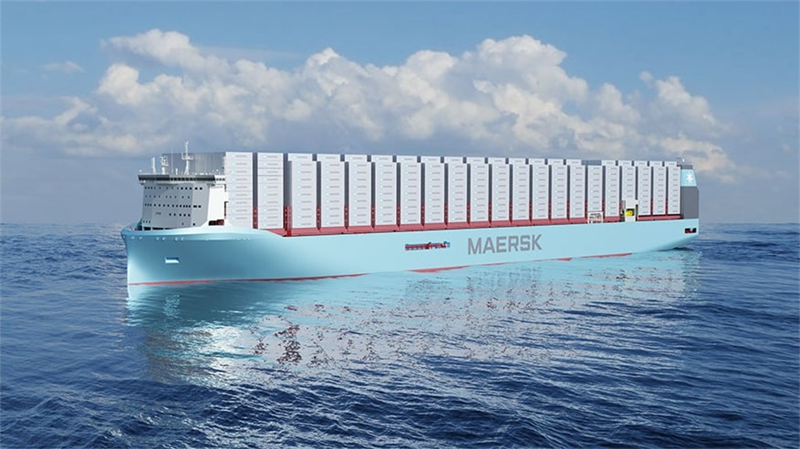

Some of the western companies promote methanol as the optimal fuel for skipping the phase of using liquefied natural gas (LNG) in the process of decarbonization. First of all, it is Maersk which ordered eight 16,000 TEU container ships on green methanol in 2021, four ships – icebreaker February 2022 and six more – in October. They are to be built by Hyundai Heavy Industries (HHI) with the delivery scheduled for 2025. The first ship is to be delivered in the first quarter of 2024. Its operation is expected to reduce annual GHG emissions by 1.5 million tonnes. When all the above-mentioned ships are put into operation, CO2 emissions will be cut by about 2.3 million tonnes per year.

However, introduction of ‘green’ methanol faces a problem of insufficient production facilities to meet the demand. Annual production is about 30 thousand tonnes while the demand exceeds 500 thousand tonnes per year.

“To transition towards decarbonisation, we need a significant and timely acceleration in the production of green fuels. Green methanol is the only market-ready and scalable available solution today for shipping. Production must be increased through collaboration across the ecosystem and around the world,” Maersk said.

In March, A.P. Moller - Maersk (Maersk) entered strategic partnerships with CIMC ENRIC (China), European Energy (Denmark), Green Technology Bank (China), Orsted (Denmark), Proman (Switzerland), and WasteFuel (USA) with the intent of sourcing at least 730,000 tonnes/year by end of 2025.

Methanol is also being considered as a fuel for heavy-lift ships. A powerful Offshore Wind Installation Vessel (WIV) is being built for Van Oord at Yantai CIMC Raffles shipyard in China. The ship is to be equipped with Wartsila methanol-fueled engines. In January 2022, the company was contracted for supply of five Wartsila 32 engines.

While speaking about engines, it should be noted that Swiss marine power company WinGD and Korean engine builder HSD Engine have initiated a Joint Development Project (JDP) to advance the development of WinGD’s methanol-fueled big-bore engines. The aim is to deliver an engine capable of running on carbon-neutral green methanol by 2024.

In this context, methanol-powered fuel cell systems is an interesting development. In September 2022, the safety concept of an innovative system architecture developed by Freudenberg e-Power Systems received Type Approval from the classification society RINA. Freudenberg e-Power Systems has developed an innovative approach to using methanol for marine applications. This combines highly efficient fuel reforming technology with a long-life PEM fuel cell in a modular, scalable system unit. It generates hydrogen via steam reforming, which then reacts with oxygen from the air in the fuel cell to produce the electrical energy needed for both propulsion and the ship’s electrical system.

As of the beginning of autumn 2022, Maersk Line, X-press Feeders and AAL Shipping have ordered a total of 26 ships that can be methanol-powered, adding momentum to the push for methanol bunkering. Meanwhile Waterfront Shipping, the shipping arm of Canadian methanol producer Methanex Corporation, has taken delivery of six chemical tankers with methanol capability.

Methanol-powered ships are in the focus of both western and Asian ship owners. In March 2022, DNV awarded an Approval in Principle (AiP) certificate to Dalian Shipbuilding Industry Company Limited (DSIC) and COSCO SHIPPING Energy Transportation Limited (CSET) for their new conceptual design of a methanol-fuelled very large crude carrier (VLCC). It is the first methanol-fuelled VLCC design from China. DNV has drawn on global resources, extensive knowledge, and expertise for the project to assure the design complies with the latest regulations and DNV’s class notation “LFL fuelled”.

In September 2022, China Merchants Energy Shipping and COSCO Shipping Bulk announced their focus on methanol marine fuel as their primary area of research in the future.

“China has set a target to achieve peak carbon and ultimately carbon neutrality and several government ministries have referenced low carbon and renewable methanol development from green hydrogen and methanol-fuelled vessels as key enablers for these policies,” says Kai Zhao, Chief China Representative, The Methanol Institute.

In April 2022, the NYK Group took delivery of the third methanol-fueled chemical tanker. Grouse Sun is equipped with a dual-fuel engine. The vessel has a new technology that suppresses the production of NOx (nitrogen oxides) by adding water to methanol to lower its temperature during combustion. As a result, the vessel can comply with the IMO’s stringent Tier III NOx emission standard and contribute to environment-friendly transportation without the need for an exhaust gas recirculation (EGR) system and a selective catalytic reduction (SCR) device.

Methanol related research is underway in Russia as well. In February 2022, new edition of Research Bulletin by Russian Maritime Register of Shipping (No 64-65) offered the analysis of using methanol and ethanol as a marine fuel.

In its July 2022 report, the research of the Lloyd’s Register Maritime Decarbonisation Hub’s Zero-Carbon Fuel Monitor (The Monitor) indicated that readiness had risen for methanol, ammonia and hydrogen across many supply chain stages compared with the end of 2021. In December 2021, The Monitor assessed the technological readiness of resources for ammonia, hydrogen and methanol based on natural gas as level 3; this went up to level 4 in June 2022.

Technology, investment and community readiness for methanol bunkering was also higher and there was also an increase in ship storage and propulsion readiness for methanol.

The findings reflect the transition of methanol bunkering from the demonstration stage to early market introduction, according to the report.

Methanol cannot be considered as an ideal fuel without disadvantages. Although the interest to methanol is increasing amid the growing prices for natural gas, dual-fuel engines entail the growth of expenses by 8-12% as compared with the conventional engines.

Besides, poisonous vapors of methanol pose risks for ship crews.

The prospects of LNG-powered shipping and other alternative fuels will be in the focus of experts and market players at the 6th conference “LNG Fleet, LNG Bunkering and Alternatives” which is to be held by PortNews Media Group on 2 November 2022 in Moscow. Visit the Conference page >>>>

More industry-related content is available on our social media pages: YouTube, Telegram, Yandex Zen