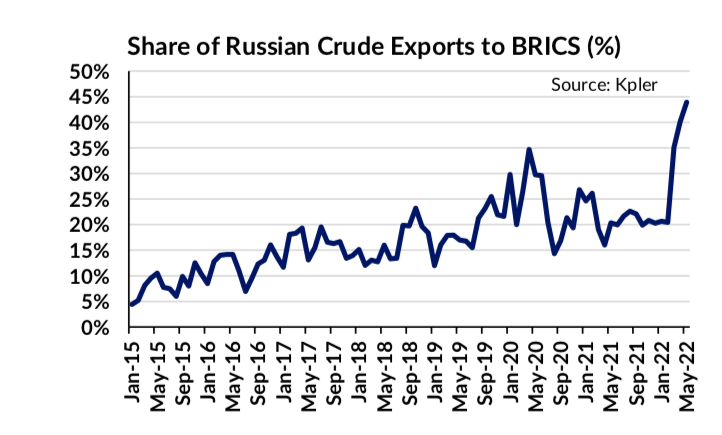

The share of Russian crude exports to Western aligned nations has been decreasing from 2015 whilst BRICS countries have been increasing their share. Moreover, with its considerable discounts Russia can build up crude oil supplies to India and China as well as supplies of clean petroleum products to Brazil and South Africa, Gibson Shipbrokers experts believe. New routes are to intensify shipping.

Between January 2015 and May 2022, BRICS bound flows increased from a mere 165 kbd to 2.250 mbd, from 4.5% to 44% of total Russian exports. During the same period non-BRICS exports fell from 3.55 mbd to 2.875 mbd, going from 95.5% to 56% of Russian crude exports, according to Kpler.

On offer is heavily discounted Russian oil and products, which is an attractive proposition at a time when oil prices are firmly above $100/bbl and inflation concerns increasingly drive policy, according to Gibson Shipbrokers’ report. In return, Russia is seeking greater imports of manufactured goods to substitute western brands that have left Russia.

On offer is heavily discounted Russian oil and products, which is an attractive proposition at a time when oil prices are firmly above $100/bbl and inflation concerns increasingly drive policy, according to Gibson Shipbrokers’ report. In return, Russia is seeking greater imports of manufactured goods to substitute western brands that have left Russia.

According to the report, Gibson expects India and China to significantly ramp up their imports given that these countries are broadly pursuing an alternative policy to that of the West, when it comes to energy security and Russia. In contrast, Brazil and South Africa are not meaningful buyers of Russian crude and are unlikely to pursue imports of Russian crude to the same extent as India and China. However, they can build up the purchase of refined oil products.

Between January 2015 and May 2022, BRICS bound flows increased from a mere 165 kbd to 2.250 mbd, from 4.5% to 44% of total Russian exports

Before February 24th, growth in the Russia–BRICS crude trade was primarily driven by sustained Chinese import growth, the experts think. Further significant changes have been seen after. Indian purchasing surged from March-2022 as discounted Urals led Indian buyers to significantly ramp up their imports. India has gone from importing 58 kbd at the start of 2022 to 987 kbd by May. China increased its imports from 896 kbd in January to 1.265 mbd in May. In terms of the CPP trade, relatively few Russian products go to BRICS nations currently, with most heading to European countries set to end Russian imports. This is likely to lead to increased CPP volumes between Russia and BRICS, according to Gibson Shipbrokers.

Brazil has been importing approximately 23 kbd of Russian CPP in 2022, whilst South Africa has not imported any. Higher CPP flows out of Russia to Brazil and South Africa could displace Middle Eastern and Indian volumes, which would then likely be rerouted longer haul to Asia and Europe, partly offsetting lost Russian products in those regions. Likewise, higher Russian CPP volumes to Latin America could displace USG volumes, which may be rerouted to Europe. As India and China increase their imports of Russian oil, this will reduce the imported volume of competing crude grades and refined products from regions such as the Middle East, WAF, USG and South America. In turn, this will offer more potential supplies for Europe and other countries looking to replace Russian imports. This will boost tonne mile demand which will in turn support freight rates.

In summer, Russia may increase oil output within its OPEC+ quota (11 million barrels per day) which cannot be achieved so far due to export problems associated with the beginning of Russia’s special military operation (SMO) in Ukraine, Deputy Prime Minister Aleksandr Novak said earlier. In June, Russia's daily output was 9.9 million barrels while in February, before the beginning of SMO and consequent sanctions — 10.2 million barrels with output in March – April falling as low as 9 million barrels per day.

According to the report, comments by Janet Yellen on a proposed plan to allow Russian exports to the West at a capped price may provide a ceiling to Russian flows shifting from West to East but the political intent of the Russian leadership may prioritise Indian and Chinese exports over that of Europe and other countries.

The trade data shows that the structural shift is underway in the tanker market towards less efficient, longer haul trade. Therefore, both tanker shipping and the world in general may have to come to terms with this new political and economic reality that Russia’s energy trade will continue despite western sanctions, summarize the experts.

More industry-related content is available on our social media pages: YouTube, Telegram, Twitter, Yandex Zen